When money’s tight, every purchase feels like a decision between “just enough” and “not quite there.” Whether it’s stretching a weekly grocery budget, deciding which bill to pay first, or worrying about an unexpected expense, living on a low income comes with daily pressures that can wear anyone down. But here’s the good news: financial stability isn’t about earning more—it’s about managing better with what’s already there.

Smart living starts with shifting focus from surviving paycheck to paycheck to building a system that works—even if the numbers are small. This guide to becoming financially stable with low income shares real, doable strategies to help create financial breathing room. From setting up a realistic budget to trimming hidden costs, each step moves you closer to a stable, less stressful way of living. Because financial peace of mind shouldn’t be reserved for those with big paychecks.

1. Start With a Realistic Budget That Reflects Your Lifestyle

When every penny counts, a budget isn’t just a spreadsheet—it’s a survival tool. But for many people, traditional budgeting advice can feel out of touch. The key is to create a plan that fits your actual life, not someone else’s idea of it. That means being honest about fixed costs, making space for small comforts, and prioritizing what truly matters—whether that’s rent, food, transport, or childcare.

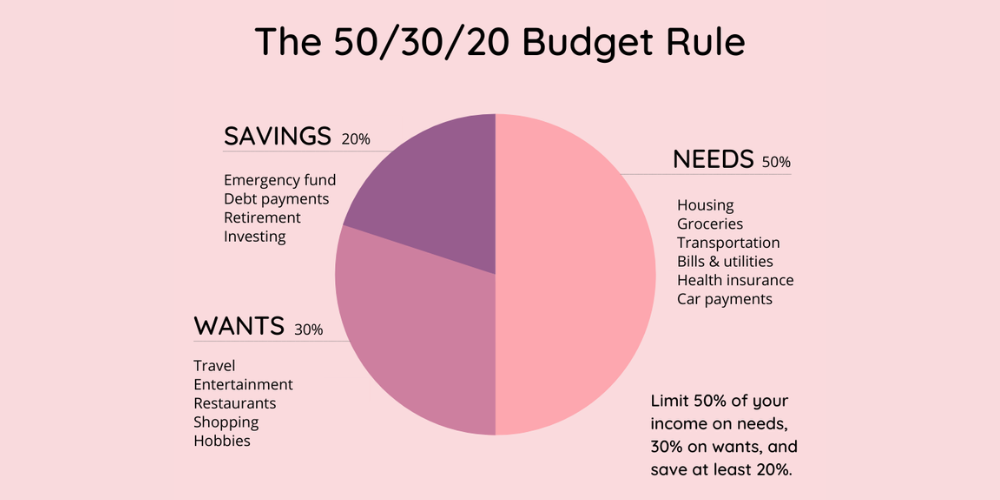

Instead of aiming for perfection, start simple. List your income, then break down your essential expenses first. After that, look at what’s left and assign it to other categories like savings, debt, or a bit of enjoyment. Tools like the 50/30/20 Budget Calculator from NerdWallet can help guide the process, but it’s okay to adjust the percentages based on your reality. A realistic budget isn’t about restriction—it’s about control. And when you’re in control, even a low income can go a long way.

2. Track Every Expense—Even the Small Ones

It’s easy to lose track of spending when the amounts feel small—£2 here, £5 there. But over time, these unnoticed purchases can quietly drain your budget. That’s why tracking every expense, no matter how minor, is one of the most powerful habits for gaining control over your finances. It shows exactly where your money is going and highlights areas where small changes could lead to big savings.

The good news is, you don’t have to do it all manually. There are free apps that connect to your bank accounts and categorize your spending automatically. Whether you prefer a simple interface or advanced features, the best expense tracker apps of 2025 can help you stay on top of every transaction. Once you start tracking, you may be surprised at how much more mindful—and confident—you become with your money.

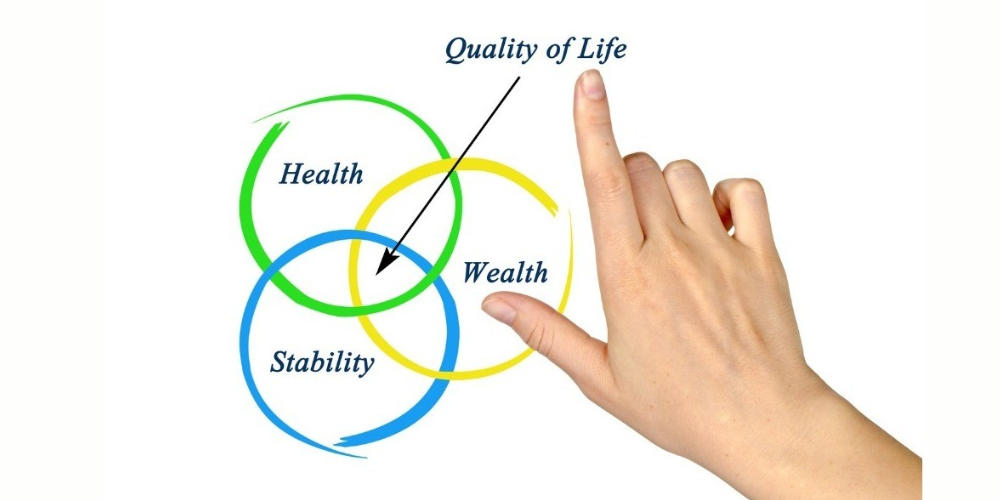

3. Cut Costs Without Cutting Quality of Life

Saving money doesn’t have to mean giving up the things that make life enjoyable. Smart living is all about finding ways to keep your lifestyle while spending less. Small adjustments—like cooking at home more often, switching to generic brands, or cancelling unused subscriptions- can have a noticeable impact. But beyond the obvious, there are dozens of creative ways to cut costs without feeling deprived.

One of the easiest wins? Use coupons and promo codes before making any purchase. Whether you’re shopping for apparel, stocking up on groceries, or upgrading your space with affordable home decor, there’s often a discount available. Sites like DiscountCodez offer a wide range of category-specific coupons, helping you save on the things you already plan to buy. Stack these savings with cashback offers or loyalty rewards and you’re keeping more money in your pocket with zero compromise.

By making smarter choices and using tools that work in your favor, you can maintain comfort while spending less, a key step toward long-term financial stability.

4. Build an Emergency Fund—Even £10 a Month Counts

When money is tight, saving might feel like a luxury—but even a small emergency fund can make a huge difference. Think of it as a financial cushion that protects you from life’s unexpected hits: a broken kettle, a flat tire, or a sudden health bill. Without a backup fund, these surprises can force people into debt or tough trade-offs. But with even a modest reserve, you gain breathing room and peace of mind.

The key is to start small and stay consistent. Begin with an amount that feels doable—£5, £10, or £20 a month—and treat it like a non-negotiable bill. Over time, those small deposits grow into something meaningful. You can also use digital tools that round up purchases and save the spare change automatically. Many banking apps now offer this “round-up” feature, helping you build savings in the background without even noticing.

To keep it separate from daily spending, open a dedicated high-interest savings account or a digital money pot labeled something clear, like “Emergency Only.” This not only keeps the money out of sight but also reinforces its purpose. And remember: the goal isn’t perfection. You’re building a habit, not hitting a number overnight. Every pound saved is a pound you won’t need to borrow later—and that’s real progress.

5. Increase Income Through Side Hustles or Upskilling

Sometimes cutting costs just isn’t enough, and that’s where boosting your income can make a real difference. You don’t need to take on another full-time job; even a small side hustle can help fill financial gaps, pay off debt faster, or grow your emergency fund. The key is to find something that fits your skills, time, and comfort level.

Opportunities are everywhere. Selling unused items online, offering local services like childcare or tutoring, or taking on remote micro-tasks are all ways to earn a little extra. For those willing to invest in future growth, free or low-cost online courses can open doors to better-paying work. Platforms like FutureLearn, Coursera, and Learn My Way offer flexible courses in areas like digital skills, finance, and marketing—all valuable in today’s job market.

Even a few extra hours a week can create noticeable breathing room in your budget. And by reinvesting that income wisely—whether into savings, debt repayment, or further learning—you build momentum that leads to long-term financial stability.

Financially Stable With Low Income: It’s Not Just a Dream

Being financially stable on a low income isn’t about luck or waiting for a raise—it’s about working smarter with what you have. By budgeting realistically, tracking spending, cutting costs thoughtfully, saving consistently, and finding ways to grow your income, stability becomes a reachable goal, not a distant dream.

Smart living doesn’t mean going without. It means making decisions that protect your future while supporting your present. With the right habits, mindset, and resources, anyone can take control of their money, no matter the size of their paycheck.

Frequently Asked Questions

Q. Can I become financially stable with low income?

Yes. Financial stability is less about how much you earn and more about how you manage what you have. With smart budgeting, tracking, saving, and supplementing income, stability is absolutely possible.

Q. How much should I save if I can only afford a small amount each month?

Start with what you can—£5, £10, or even spare change. The goal is consistency. Over time, small amounts grow and build the habit of saving, which is more important than the amount itself.

Q. What’s the best budgeting method for low-income?

The 50/30/20 rule is a useful guide, but it can be adjusted to fit your situation. Prioritize essentials first, then assign what’s left to savings, debt, or occasional treats. A personalized, realistic plan works best.

Q. What apps can help me track spending automatically?

Apps like Emma, Money Dashboard, and those listed in CNBC’s top expense tracker apps for 2025 are great options. They connect to your accounts and categorize expenses to help you stay aware of your spending habits.

Q. Are there free ways to learn new skills and boost income?

Yes. Platforms like FutureLearn, Learn My Way, and Coursera offer free or low-cost online courses in practical and in-demand skills—from digital marketing to basic coding—that can improve job prospects or support side hustles.

Q. How do I avoid feeling restricted while cutting costs?

Focus on cutting costs, not joy. Keep small comforts in your budget, swap paid activities with free ones, and use discounts where possible. Saving money shouldn’t feel like punishment—it should feel empowering.

Q. Where can I find coupons to save on essentials?

Check out DiscountCodez for free coupons across categories like apparel, grocery, and home decor. Using them regularly can significantly reduce monthly expenses without changing your lifestyle.